Without exaggeration, diversification is one of the most powerful tools of a trader, allowing to enhance many characteristics of a system with relatively little effort.

However, as with many things, one has to be very careful on using it properly.

How to exactly define and approach diversification is not trivial, and I may have a series of posts on this. For now, as an example, I’ll try to increase the Sharpe Ratio of a strategy through diversification (whether Sharpe’s improvement is something to aim at is another matter).

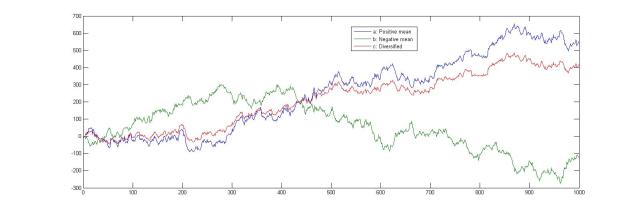

To prove the point, I generated two negatively correlated (rho = -0.4) series of numbers and created two virtual strategies performance series out of them.

From these, I then created a “diversified system” composed of the two sub strategies. To make things comparable, the diversified system weights the two strategies so that the total weight sums up to 1, so that the virtual allocated capital is the same in the 3 cases.

As you may have guessed, this system shows an higher Sharpe than any of the two individual strategies (*note of caution on this at the bottom of the post).

What’s really interesting, however, is that one of the 2 starting strategies is a loser. Here are the Sharpe of the 3 strategies:

Sharpe ratio 1 0.86

Sharpe ratio 2 -0.19

Sharpe ratio diversified: 0.88

Adding a losing strategy to a profitable strategy increased the Sharpe Ratio of our system.

Put it this way, improving the “performance” of a system seems quite simple, we don’t even need to find a profitable strategy!

Is it really that simple? Well, no…it really depends on your definition of “performance”.

As discussed extensively (here and here), Sharpe Ratio is not a perfect measure of performance.

In this case, the catch is that the total return of the diversified system is lower than the total return of the profitable strategy. Here is a plot of the strategies results:

Although at the end of the day the evaluation of a system boils down to the utility function of your choice, personally I would not add a losing strategy to a system just to improve its Sharpe Ratio. I would rather allocate part of the capital to the cash, or even just hide it under the mattress.

Andrea

*Note of caution: combining two negatively correlated strategy doesn’t always increase the Sharpe Ratio of the individual strategies, main reason being that mere correlation is not able to exhaustively quantify the relationship between two time series (looking at the covariance matrix of strategies returns and at its evolution over time may be a more sophisticated approach)

can you email me david@axiomfutures.com?